The Question of Inflation

There is a lot of disinformation swirling about the cause of inflation. One of the most perplexing aspects of this to me is that of all common targets for blame (government spending, supply chain problems, business monopolies), one, and in my view the most important one, is left out: Federal Reserve policy.

Most people, including most financial journalists, do not have an education in money and banking, which includes the role of the central bank (the federal reserve in our case) in maintaining stable prices.

Most people can, however, intuitively understand that if the central bank creates money at a faster rate than the economy grows, general price inflation will result: Otherwise put: too much money will be chasing too few goods. This has been the history of many Latin American countries, and the recent history of ours.

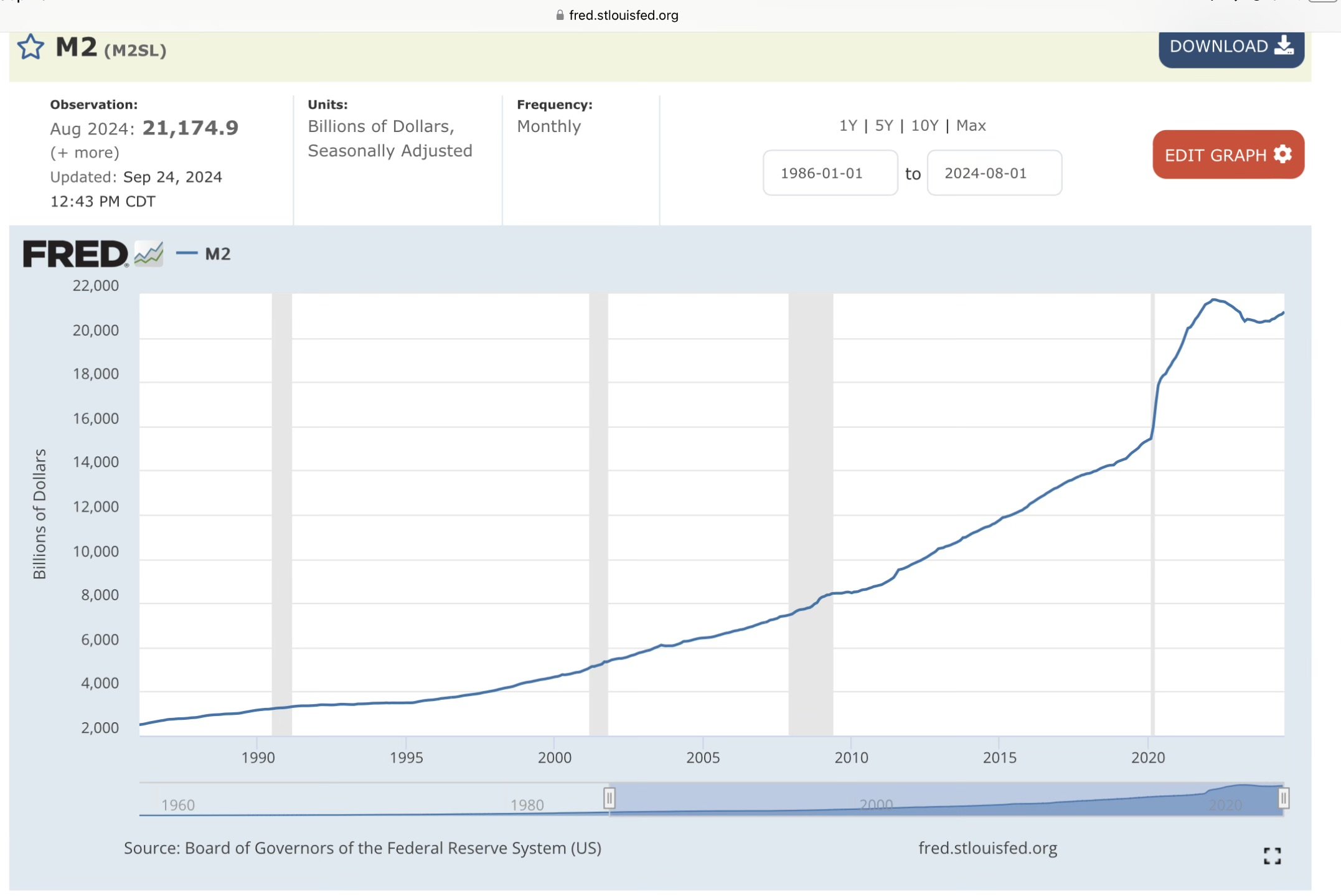

Take a look at the following chart of money supply (in this case M2) growth. Note that starting with Greenspan in 1987 through Yellen in 2018, M2 grew at an annual rate of about 5.45% per year. This rate, minus the real rate of GDP growth, resulted in fairly stable prices over the period. (This included the increase in money supply to combat the financial crisis of 2008.)

During the Powell years, however, money supply grew from $14 trillion to a peak in 2022 of $22 trillion, or at an annual rate of 9.5%. Accordingly, the gap between this rate of growth and the growth of GDP resulted in significant inflation. That alone would have been consequential, but add to it the fact that due to COVID related supply issues as well as the inability of many people to work, GDP actually declined for a period of time, thereby magnifying the impact of the unparalleled money supply growth. Essentially, Powell funded, or monetized, the COVID related surge of government spending during the period and created inflation.

As you can see from the chart below, Powell has finally stopped the growth of money which is fundamentally why inflation is coming under control. The damage, however, has been done as we have all suffered a decline in purchasing power.

This leads to a very perplexing question: How has Powell avoided all responsibility for our current inflation problem? And why did Biden reappoint him given what should have been an obvious looming problem? Instead, Powell has positioned himself as the person who will fix the problem with increased interest rates and slower money supply growth. But if he can fix it, shouldn't it be obvious that he created it?